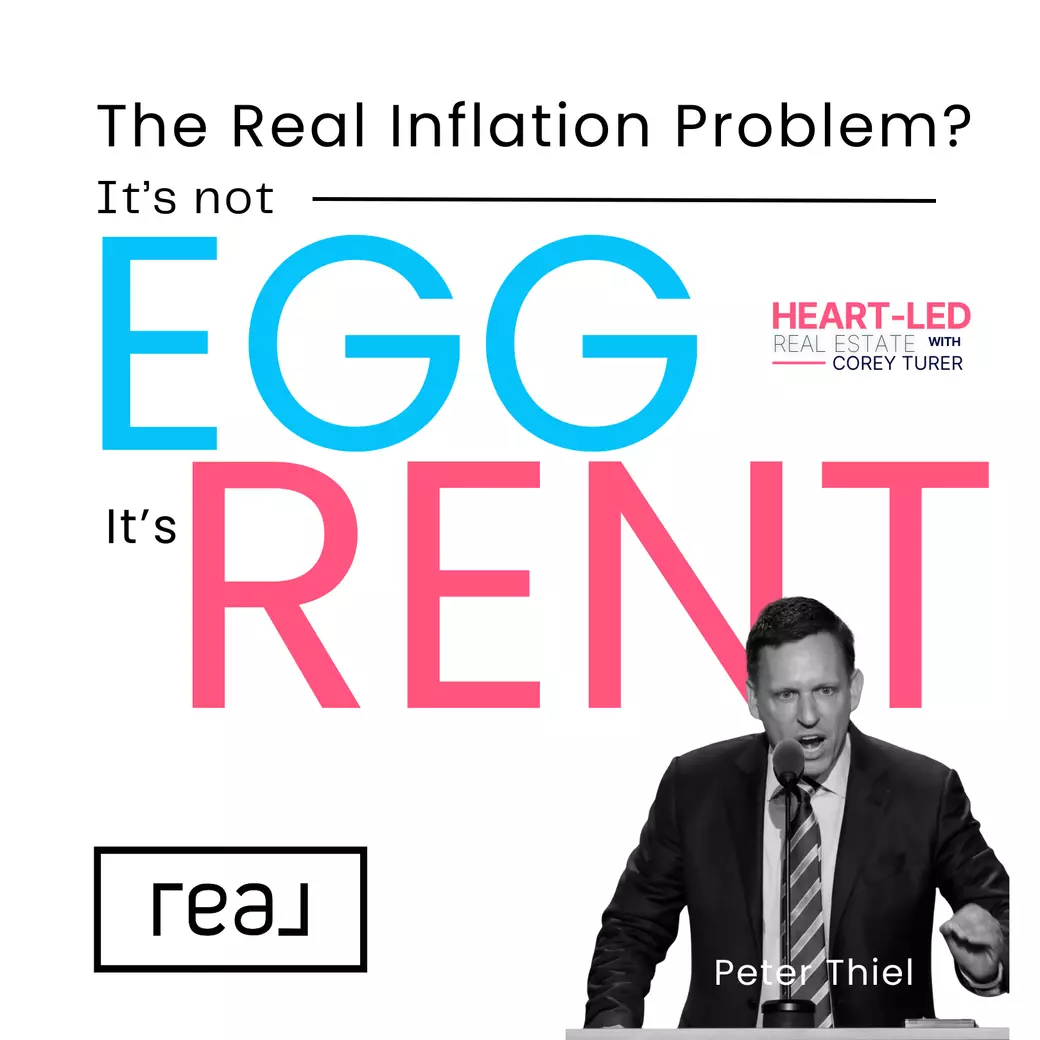

Rent vs. Buy—Why Young Americans Are Losing the Wealth Game

Rent keeps rising, wages stay flat, and homeownership remains a distant dream for many. Peter Thiel calls it a ‘real estate catastrophe.’ Source: Yahoo Finance

The Problem?

-

Home prices surge when populations grow, but wages don’t keep pace.

-

Zoning laws restrict new housing, keeping supply low and demand high.

-

Rent inflation is eating up paychecks, making it harder to save for a down payment.

Who Wins?

-

Boomers and upper-middle-class homeowners, who watch their property values climb.

-

Landlords, who benefit from rising rents and a market that forces young buyers to stay renting.

Who Loses?

-

Young buyers stuck in a cycle of rising costs with little chance to build equity.

-

The lower middle class, who see housing costs taking up an ever-larger share of their income.

The Historical Perspective

Economist Henry George argued over a century ago that land monopolization leads to wealth inequality. His theory, known as Georgism, suggests that land value taxation could reduce economic disparity. His ideas remain relevant today as housing costs soar. Further Reading: Henry George’s Economic Theories

Potential Solutions

Experts suggest several ways to fix the broken system:

-

Expanding housing supply: Reforming zoning laws to allow for more development.

-

Rent control policies: Some advocate for limits on rent increases to protect tenants.

-

First-time homebuyer programs: Government-backed initiatives that help buyers with down payments.

-

Land value tax: Inspired by Georgist principles, this tax would shift the burden away from income and toward landowners who benefit from rising property values.

Thiel’s warning is clear: without policy changes, homeownership will become a privilege for the few, not a path to wealth for many.

Categories

Recent Posts

GET MORE INFORMATION